Arizona Withholding Percentage How To Choose 2024. You're not required to submit a new a4 unless you don't want the standard tax rate:. To estimate your tax return for 2024/25, please select the 2024.

Enter your details to estimate your salary after tax. Welcome to the arizona withholding percentage calculator, a handy tool to help you determine the correct withholding percentage for your employees in the state of arizona.

Enter Your Details To Estimate Your Salary After Tax.

The arizona state tax calculator (azs tax calculator) uses the latest federal tax tables and state tax tables for 2024/25.

Arizona’s Employees Have New Tax Withholding Options.

The new default withholding rate for az is 2 percent, so now is the time to.

Form To Change The Arizona Withholding Percentage Or Change The Extra Amount Withheld.

Images References :

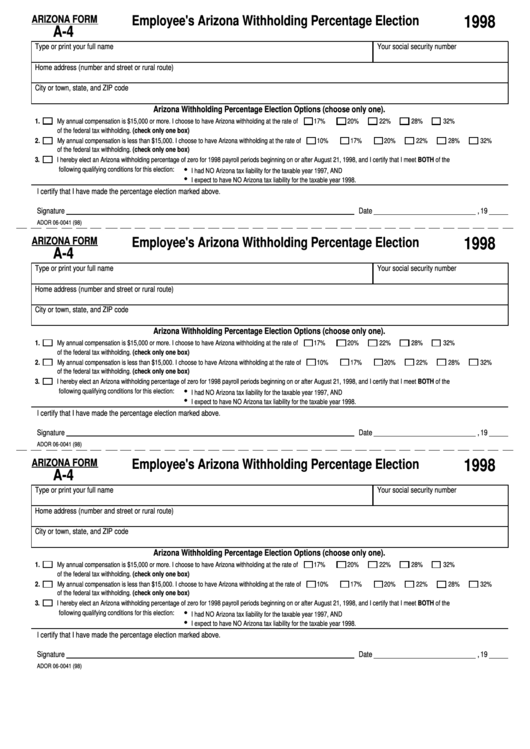

Source: printableformsfree.com

Source: printableformsfree.com

Arizona State Withholding Form 2023 Printable Forms Free Online, Use our income tax calculator to find out what your take home pay will be in arizona for the tax year. To estimate your tax return for 2024/25, please select the 2024.

Source: www.clrvw.com

Source: www.clrvw.com

Arizona Withholding Percentage How to Choose A4 Form, Changes to the 2023 tax rate structure mean changes to state withholdings from your paychecks. Employees can select any of the form’s.

Source: www.employeeform.net

Source: www.employeeform.net

Arizona Tax Rate For New Employee Forms 2022, The 2024 tax rates and thresholds for both the arizona state tax tables and federal tax tables are comprehensively integrated into the arizona tax. You're not required to submit a new a4 unless you don't want the standard tax rate:.

Source: printableformsfree.com

Source: printableformsfree.com

New A 4 Form 2023 Printable Forms Free Online, The arizona state tax calculator (azs tax calculator) uses the latest federal tax tables and state tax tables for 2024/25. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

Source: printableformsfree.com

Source: printableformsfree.com

Arizona Employee Withholding Form 2023 Printable Forms Free Online, Changes to the 2023 tax rate structure mean changes to state withholdings from your paychecks. Arizona’s employees have new tax withholding options.

Source: www.speedytemplate.com

Source: www.speedytemplate.com

Free Arizona Form A4 (2013) PDF 30KB 1 Page(s), 2024 tax calculator for arizona. Form to change the arizona withholding percentage or change the extra amount withheld.

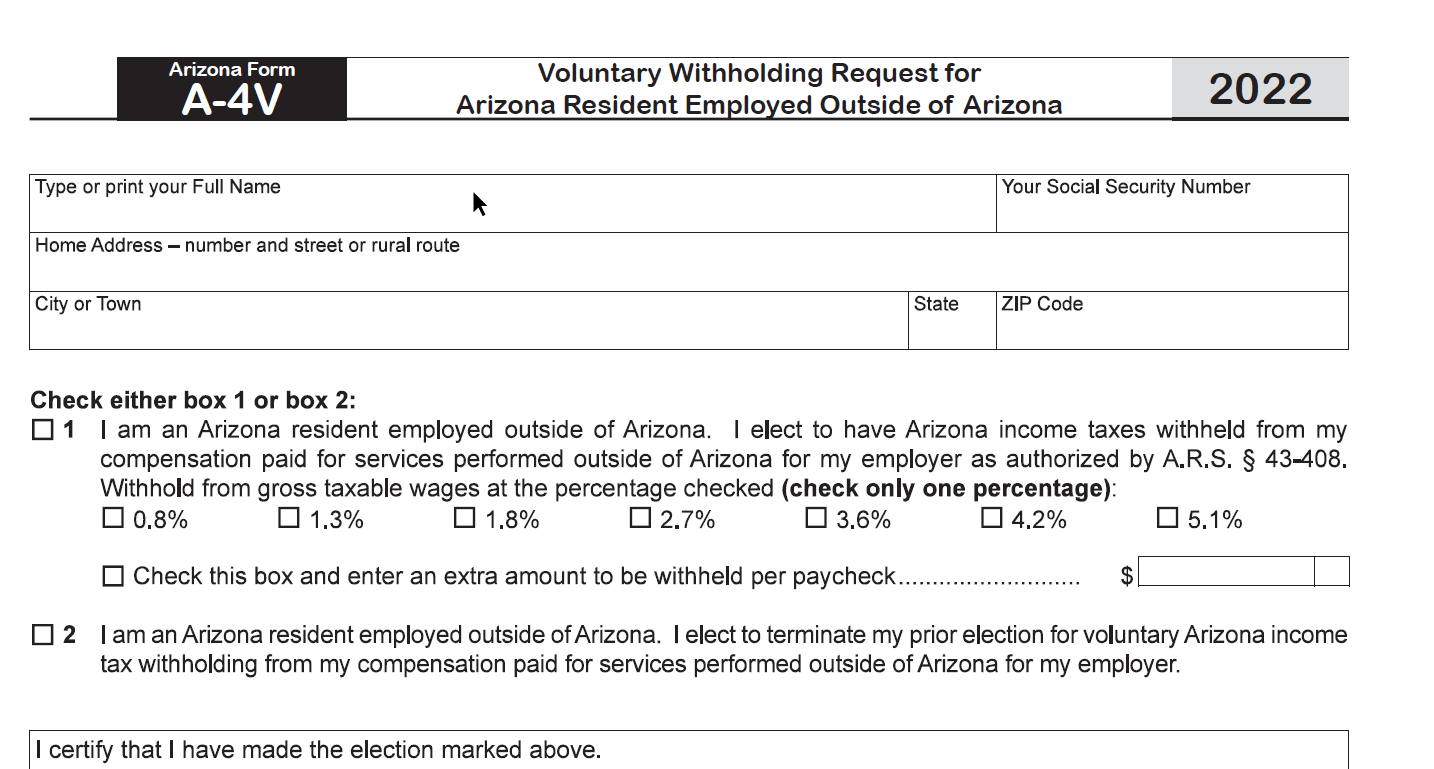

Source: avionteclassicsupport.zendesk.com

Source: avionteclassicsupport.zendesk.com

Arizona Voluntary Withholding Avionte Classic, There are three types of. Enter your details to estimate your salary after tax.

Source: www.groupmgmt.com

Source: www.groupmgmt.com

Employee Withholding Form Updated In Arizona PEO & Human Resources Blog, The 2024 tax rates and thresholds for both the arizona state tax tables and federal tax tables are comprehensively integrated into the arizona tax. Now, the department states that the tax rates to be reflected on.

Source: www.matpc.com

Source: www.matpc.com

New Arizona Form A4 Yuma Accountant & CPA in Yuma, AZ Misenhimer, The 2024 tax rates and thresholds for both the arizona state tax tables and federal tax tables are comprehensively integrated into the arizona tax. The new default withholding rate for az is 2 percent, so now is the time to.

Source: debeeqardelia.pages.dev

Source: debeeqardelia.pages.dev

Az Tax Brackets 2024 Arlena Olivia, The withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Changes to the 2023 tax rate structure mean changes to state withholdings from your paychecks.

Use Smartasset's Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Account Federal, State, And Local Taxes.

The withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck.

Check Your Current Rate, And Then Determine If 2% Is Enough Or Not Enough For Withholding.

7 rows the state withholding calculator helps you determine whether you need to give your.